As China continues to develop, so does its global influence. What would the future be like for South-East Asia with a ‘risen China’?

|

Rising together: No, Chinese imperialism is not simply replacing US imperialism, as China emphasises win-win partnerships, says Prof Zhang. — Handout

|

China in the Asian century

PROF Zhang Weiwei is among the most respected scholars in China today. He is a leading expert on China’s “reform and opening up” policies and its status as a “civilisational state.”

As director of the China Institute at Shanghai’s elite Fudan University, he is also professor of International Relations and had served as English interpreter for China’s Paramount Leader Deng Xiaoping. In an exclusive interview earlier in the week, Prof Zhang spoke to Sunday Star about future prospects with China.

As the leading authority on China’s civilisational state, how would you define it, as distinct from a nation state?

With China, it’s a combination of the world’s longest continuous civilisation and a super-large modern state. A civilisational state is made up of hundreds of states amalgamated into one large state.

China is a modern state respecting international law like a nation state, but culturally diverse, with sovereignty and territorial integrity.

There are four features of China’s civilisational state: a super-large population of 1.4 billion people, a continent-size territory, significant culture, and a long history.

If we are returning to an East Asian tributary system, what changes can we expect in China’s policies in this region today?

The tributary system is a Western name for China’s relations in this region (in the past). China is a “civilisational” – as an adjective – state, a modern amalgamation of many (component communities).

During the Ming Dynasty, China was a world power – but as a civilizational state more than a nation state – and did not seek to colonize other countries, unlike Western powers that were nation states. Since then, China’s status and capacity as a nation state has grown significantly. Will it then become more like Western powers now?

China today is a nation state, but different from European (nation) states. It is also still a civilisational state.

The Chinese people are not just Han, although the Han majority is 92%. There are 56 ethnic groups in China, (mostly) minorities.

But China rejected the Permanent Court of Arbitration’s ruling on the South China Sea, initiated by the Philippines, which found China’s claims insupportable.

The tribunal was illegal; it had no right to make such decisions. The Permanent Court of Arbitration is not part of the United Nations.

How can countries in South-East Asia be convinced that the rise of China will not simply result in Chinese imperialism replacing US imperialism?

China emphasises win-win partnerships, such as in the Belt and Road Initiative (BRI). It encourages discovering, building, and benefiting together.

Countries in South-East Asia join the BRI out of their own interest. It is not something imposed by China.

Some countries have described the Second Belt and Road Summit this year as being more consultative than the first. As for the future?

The future Belt and Road Summits will be even more open and consultative.

Is the current US-China trade dispute only a symptom of much larger differences, such as a historic divide in the reshaping of a new global order?

It is more than about trade. With the United States especially, it is zero-sum, but for China it is win-win.

The Chinese economy is larger than the US economy, or soon will be. (In PPP or purchasing power parity terms, China’s economy grew larger than the US economy in 2014.)

The United States is trying to decouple its economy from China’s. How can China ensure that it would not only withstand these efforts but also triumph?

The attempt to decouple the two economies will fail. About 85% of US companies that are already in China want to stay.

Looking at the trade structure, most Chinese exports to the US are irreplaceable. No other place in the world gives a better price-quality ratio in manufactured goods.

So the US cannot win in this decoupling because there are no alternatives (as desirable producing countries). China has the world’s largest chain or network, or factory clusters, for all kinds of goods.

How likely do you see a hot war – more than a trade war or a cold war – breaking out between a rising China and what is perceived to be a declining United States?

The US knows that it won’t win (a hot war). No two nuclear-armed countries will go to war. It would be very messy.

So far no two nuclear-armed countries have fought. There may be a small likelihood of direct confrontation, but not a war situation.

No commercial shipping has been interrupted by China. So the US need not worry.

Can Asean, or an Asean country like Malaysia, help to bring the United States and China closer together as partners rather than as rivals?

Possibly. Malaysia perhaps can help, as it is friendly to both China and the US.

As China continues in its rise, what steps is it taking to provide for more cooperative and consultative relations in this region?

Trade between China and Asean countries, for example, has grown, and has now exceeded China-US trade.

Generally, China’s relations with Asean countries are quite promising, with Free Trade Area relationships as well.

By Bunn Nagara, who is Senior Fellow at the Institute of Strategic and International Studies (ISIS) Malaysia.

Source link

Poised for growth: Shipping containers sit stacked next to gantry cranes at the Yantian International Container Terminals in Shenzhen, China. — Bloomberg

Is the future truly Asian?

The Region, while growing fast, faces issues such as youth joblessness, climate change and income gaps

THIS is a question that is at the heart of the tensions across the Pacific.

To Parag Khanna, author of The Future Is Asian (2019), the answer is almost self-evident.

However, if you read his book carefully, you will find that he thinks global power will be shared between Asian and Western civilisations

For the West, the rise of Asia has been frighteningly fast, because as late as 1960, most of Asia was poor, agricultural and rural, with an average income per capita of less than US$1,000 in 2010 prices.

But 50 years on, Asia has become more urban and industrialised, and is becoming a challenge to the West in terms of trade, income and innovation.

Global management consulting firm McKinsey has just published a study on “The Future is Asian” that highlights many aspects why Asia is both attractive to businessmen and yet feared as a competitor.

Conventionally, excluding the Middle East and Iran, Asia is divided into North-East Asia (China, Japan and South Korea), South-East Asia (mostly Asean), South Asia (India, Pakistan, Bangladesh) and Central Asia.

But McKinsey has identified at least four Asias that are quite complementary to each other.

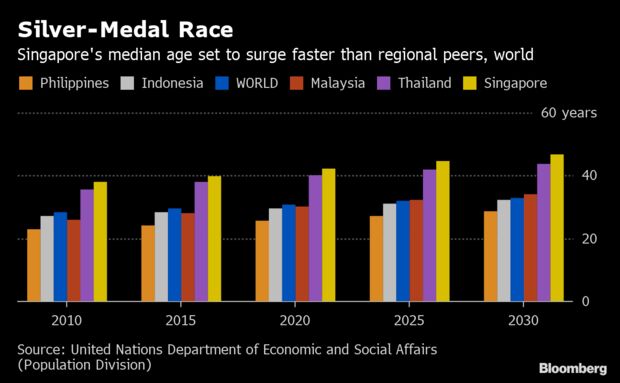

First, there is Advanced Asia, comprising Australia, Japan, New Zealand, South Korea and Singapore, each with per capita incomes exceeding US$30,000 (RM125,600), highly urbanised and rich, with a combined GDP that is 10% of global GDP.

This group provides technology, capital and markets for the rest of Asia, but it is ageing fast.

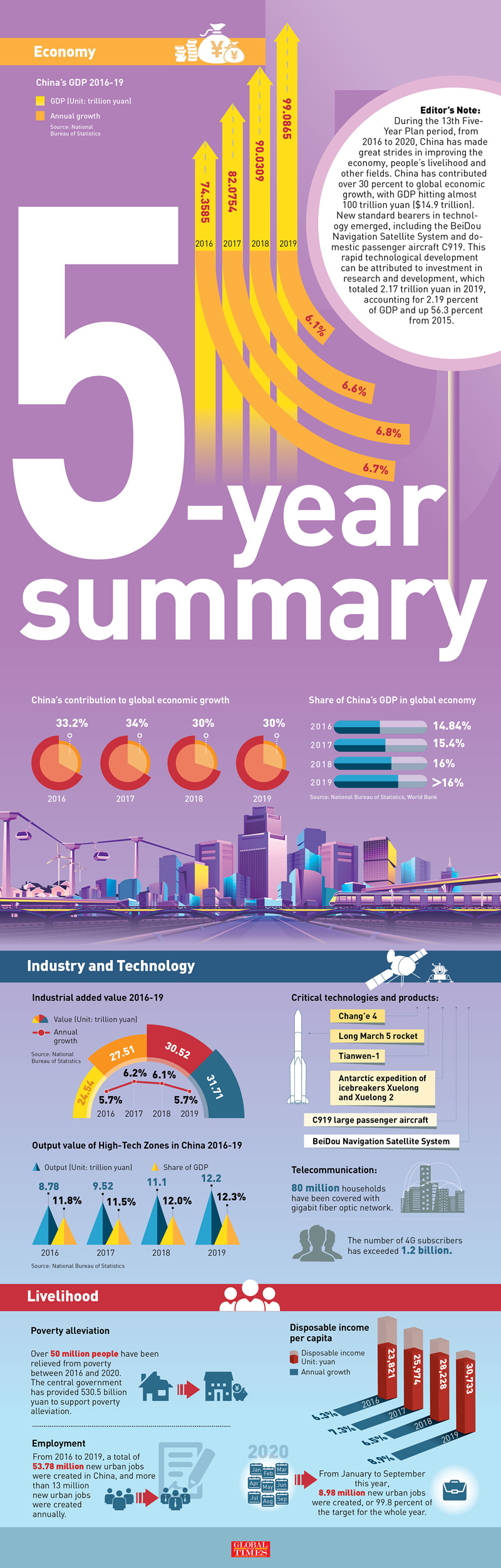

Second, China is the world’s largest trading economy, second largest in GDP after the United States, and a growing consumer powerhouse. By 2030, the Chinese consumer market will be equal to Western Europe and the United States combined.

China is also an increasing capital provider to the rest of the world.

Third, the 11 countries of Emerging Asia (Asean plus Bhutan and Nepal, excluding Singapore) have young populations, fast growth and cultural diversity.

Fourth, Frontier Asia and India – covering essentially South and Central Asia including Afghanistan – which have 1.8 billion in population, still rural but young.

Taken together, these four Asias today account for one-third of global GDP and 40% of the world’s middle class.

But what is remarkable is that while the region grew from trading with the rest of the world, intra-regional trade has grown faster, to 60% of total trade, with intra-regional foreign direct investment (FDI) at 66% of total inward FDI, and 74% of air traffic.

Much of Asian growth will come from rapid urbanisation, amid growing connectivity with each other. The top 20 cities in Asia will be mega conglomerates that are among the largest cities in the world with the fastest-growing income.

A major finding is that America First-style protectionism is helping to intensify the localisation and regionalisation of intra-regional connectivity in terms of trade, finance, knowledge and cultural networks.

Furthermore, the traditional savings surpluses in Asia basically went to London and New York and were recycled back in terms of foreign direct investment and portfolio flows.

But no longer.

Increasingly, Asian financial centres are emerging to compete to re-pump surplus capital from Advanced Asia and China to fund the growth in Emerging and Frontier Asia.

In short, intra-regional finance is following intra-regional trade.

In a multipolar world, no one wants to be completely dependent on any single player but prefers network connectivity to other cities and centres of activity and creativity.

As Khanna puts it: “The phrase ‘China-led Asia’ is thus no more acceptable to most Asians than the notion of a ‘US-led West’ is to Europeans.”

But are such rosy growth prospects in Asia predestined or ordained?

Based on the trajectory of demographic growth of half the world’s young population moving into middle income, the logical answer appears to be yes.

But there are at least three major bumps in that trajectory.

First, Asia, like the rest of the world, is highly vulnerable to global warming.

Large populations with faster growth mean more energy consumption, carbon emissions and natural resource degradation. Large chunks of Asia will be vulnerable to more water, food and energy stresses, as well as natural disasters (rising seas, forest fires, pandemics, typhoons, etc).

Second, even though more Asians have been lifted out of poverty, domestic inequality of income and wealth has increased in the last 20 years.

Part of this is caused by rural-urban disparities, and widening gaps in high-value knowledge and skills. Without adequate social safety nets, healthcare and social security, dissatisfaction over youth unemployment, access to housing, and deafness to problems by bureaucracies has erupted in protests everywhere.

Third, geopolitical rivalry has meant that there will be tensions between diverse Asia over territorial, cultural and religious differences that can rapidly escalate into conflict. The region is beginning to spend more on armaments and defence instead of focusing on alleviating poverty and addressing the common threat of climate change.

Two generational leaders from the West have approached these threats from very different angles.

Addressing the United Nations, 16-year-old Swedish schoolgirl Greta Thunberg dramatically shamed the older generation for its lack of action on climate change.

“People are suffering. People are dying. Entire ecosystems are collapsing. We are at the beginning of a mass extinction and all you can talk about is money and fairy tales of eternal economic growth. How dare you, ” she said.

The young are idealistically appealing for unity in action against a common fate.

In contrast, addressing the UN Security Council, US President Donald Trump was arguing the case for patriotism as a solution to global issues. Climate change was not mentioned at all.

Since the older generation created most of the carbon emissions in the first place, no wonder the young are asking why they are inheriting all the problems that the old deny.

This then is the difference in passion between generations.

Globalisation occurred because of increasing flows of trade, finance, data and people. That is not stoppable by patriot-protected borders.

A multipolar Asia within a multipolar world means that even America First, however strong, will have to work with everyone, despite differences in worldviews.

All patriots will have to remember that it is the richness of diversity that keeps the world in balance.

The writer ANDREW SHENG is a distinguished fellow with the Asia Global Institute at the University of Hong Kong. This article is part of the Asian Editors Circle series, a weekly commentary by editors from the Asia News Network, an alliance of 24 news media titles across the region.

Source link

Read more:

Read more:

China in the Asian century – Chinadaily

Related posts: