|

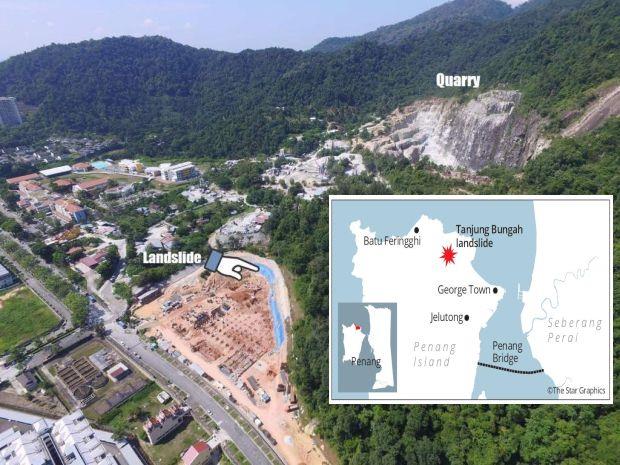

Looking ahead: An aerial view of Penang’s Free Industrial Zone. Penang

is banking on land reclamation to the south of the island to help fund

the state’s economic development. |

|

|

ALMOST three decades ago, my then news editor Nizam Mohamad tried to convince me to work in Kuala Lumpur instead of remaining content in Penang, but like most Penangites, I enjoyed the slower pace of life on the island.

The food was good, the beach was marvellous, and I could be with my sweetheart, now my wife. I had my friends, who were my schoolmates, and my family members.

Finally, when the Commonwealth Heads of Government summit was held in KL in 1990, Nizam asked me to “help out with the coverage”.

When I reported for duty, he handed me my transfer letter on the spot. It was as simple as that, and I remember he told me that “you would go nowhere if you remain in Penang”.

For decades, skills migration and brain drain, and the lack of high-quality job opportunities, has been Penang’s Achilles heel.

Shoe designer Datuk Jimmy Choo wouldn’t have become a world icon had he remained in George Town. The same fate could have befallen sports personalities Datuk Lee Chong Wei and Datuk Nicol David had they, too, not moved to KL.

Munich-based Datuk Ooi Chean See would have no renowned orchestra to conduct if she were still in Penang, and Hong Kong-based fund manager, Datuk Seri Cheah Cheng Hye, wouldn’t be a billionaire had he stayed put in the state.

Nizam was right, and I am thankful for his foresight. Like many of my fellow islanders, our careers have moved up and onwards since moving to the nation’s capital, given its greater opportunities.

Penangites, many of whom now work outside the state, generally also lack properties in the state because we no longer live there. The rental yield simply doesn’t make business sense for investment.

The truth is, Penang is stagnating and hasn’t been able to reinvent itself. The state remains dependent on the electrical and electronics (E&E) sector. Putting it more accurately, with a GDP of RM80bil, half of Penang’s economy is reliant on this sector with the other half on tourism and the services industry.

Despite having achieved a high growth rate of 11% per annum between 1970 and 2008, growing from RM790mil in 1970 to RM49bil in 2008, GDP growth rate has slowed down to 5% for the past 10 years.

The past decade also saw GDP per capita easing off to 4% per annum, and with inflation at 3% per annum, the standard of living for Penangites has been on the decline, relative to the past four decades.

Growing up on the island, where I spent much time at the Batu Ferringhi beaches, we all know why it’s now hard for Penang to compete against the likes of Bali, Phuket and Koh Lipe as its beaches and water have simply lost their lustre.

Penang can no longer call itself the “The Pearl Of The Orient” or even “Penang Leads”, a tagline locals revelled in during the era of then Chief Minister Tun Dr Lim Chong Eu.

The state is losing ground in tourism, especially with it having not invested sufficiently in this sector, a situation compounded by how cities around the world are reinventing themselves.

In the E&E sector, we are trapped between China and Vietnam, two fast-moving low-cost locations, while Singapore and Taiwan portray highly skilled research and design centres. Basically, we’ve lost out on both ends.

More discouraging is how Penang, especially the island side with its premium value, has run out of land for safe development, open spaces and infrastructure.

Much of the state’s people are unaware that almost 40% of Penang’s land is classified as Class III or above. This classification means that the terrain is sloped at more than 25 degrees, measured from a horizontal plane.

These are the foliaged hilly and sloppy terrains subjected to undue pressure from hillside developments. Recent catastrophes of landslides, floods and fatalities remain etched in our minds.

It has become increasingly difficult to buy homes on the island, and it’s common knowledge how rich Singaporeans have snapped up the pre-war homes in heritage sites there for a song.

As land becomes scarcer, the manufacturing and services sector will not be able to grow and will remain stunted.

That could all change soon with the state and federal governments now under the rule of the same political coalition. The state needs to accelerate its inevitable transformation which will fundamentally change the way Penangites live and work, and it needs to embrace digital economy, globalisation and urbanisation. To put it succinctly, Penang must brand itself a Smart City.

In other countries, there is always a second city – Beijing and Shanghai, Sydney and Melbourne, Hanoi and Ho Chin Minh, New York and Los Angeles. However, George Town has never been able to capture the second city status (partnering KL), and it must now compete with Johor Baru for that prestigious identity. Penang has severely lagged.

Understandably, most Penangites are averse to change. Putting up buildings doesn’t mean development, and besides, no one comes to Penang to see skyscrapers. The quality of life is important, and it’s fortunate that Penang has a vibrant civil society.

The non-governmental organisations are alert and outspoken, and that’s what a mature democracy should be like – keeping a close eye on politicians.

But Penang can’t remain stagnant, so it needs land. All around the world, land reclamation is a norm. Just look at Singapore and Hong Kong. Manhattan wouldn’t exist if New York didn’t add land to it. And if Johor hadn’t done the same, Singaporeans can see Johoreans from their flats, as they reclaim without any debates.

“Location, location, location” is the mantra of land developers. The plan to create three man-made islands, totalling 1,821ha (4,500 acres) under the Penang South Reclamation Scheme (PSR) is proof of heading in the right direction. The RM70bil deal involves the construction of the RM9bil rail transit (LRT) line, the RM9.6bil Pan Island Link 1 (PIL1) and other supporting infrastructure projects under the Penang Transport Master Plan (PTMP). see more below …

Land may be in abundance on the mainland, but the island is the preferred choice, because in terms of value, it has always fetched higher prices. Having the three islands next to the Bayan Lepas Industrial Zone, the Penang International Airport and the Second Penang Bridge is the right thing to do.

Malaysia’s E&E industry is centred in Bayan Lepas, contributing RM120bil in exports, and these islands will help boost this crucial sector further, and encourage Penang to reinvent itself as a digital economy.

A properly planned transport link is long overdue. For years, I have made it a point to return to Penang for the reunion dinner days ahead of Chinese New Year, simply because I can no longer handle the stress of traffic jams on the island.

The final straw was when a jaga kereta boy demanded RM10 for my car, which was parked near Kek Lok Si temple where my wife used to live, because “you have a KL number plate” and “you are not a Penangite”.

Although Penang was the first state in Malaya to introduce a tram system (in the 1880s), the streets there are simply too narrow. So, while it sounds good in theory, it’s just not practical.

Going above the streets – like what modern rails do – is the right thing, and such an “elevated” move will remove the chaos each time it rains and transforms George Town into a huge canal.

The bottom line is, the E&E sector is stagnant, tourism earnings have reduced, Penang isn’t on the global business map, traffic congestion is horrendous, housing on the island is unsustainable and worse, the best brains will not come to Penang for career advancement.

You can have investments, but it doesn’t make sense if the best talents are not attracted to work in the state. There is only so much char koay teow one can eat in Penang.

It’s no good for Penang to be a pick for expatriate retirees. Instead, we need it to be a choice for the workforce, both Malaysian and foreign, from the knowledge economy, supporting services, manufacturing and renewed tourism industries. Penang must move up the value chain to reclaim its lost stature of “Penang Leads”.

By Wong Chun Wai – comment The Star

RM70bil will be flowing in from here

Penang can expect to raise over RM70bil through projects

This is the plan – set up three man-made islands under the Penang South Reclamation Scheme and then, rake in enough to finance the state’s economic development for the next 30 years.

GEORGE TOWN: Over RM70bil is expected to be raised from the three man-made islands under the Penang South Reclamation Scheme (PSR), enough to spearhead the state’s economic development for the next 30 years.

Sources told The Star that out of the more than RM70bil, about RM46bil would be used for the construction of the RM9bil light rail transit (LRT) line, the RM9.6bil Pan Island Link 1 (PIL 1), and other supporting infrastructure projects under the Penang Transport Master Plan (PTMP).

According to a prominent Penang developer, the present price of industrial land on the island would be around RM70-RM200psf, depending on its status as leasehold or freehold land.

Because the industrial lots on the island are freehold land, the pricing is around RM20psf.

“When the reclamation of the islands starts in 2020, there could be at a 10% appreciation. The island will be sold via an open tender process,” he said.

It will take at least six years for the reclamation, which will be done in stages, to be completed.

It was previously reported that sources had said that about 75% of the three islands were for sale, with some 30% of the enquiries received so far being for industrial land.

When contacted, a local manufacturing company said it would be interested to bid for the lots once an open tender was called.

“There’s currently a slowdown in the manufacturing sector. When the reclamation is done, the global economy should also see a recovery,” said its spokesman.

The National Physical Planning Council is expected to approve the reclamation of the three islands, totalling 1,821ha (4,500acres), before the end of this month.

The SRS Consortium – a 60:20:20 joint venture involving Gamuda Bhd, Loh Phoy Yen Holdings Sdn Bhd and Ideal Property Development Sdn Bhd – is the project delivery partner, appointed by the state government to oversee the implementation of the LRT, PIL 1 and PSR scheme, components of the PTMP.

It was also earlier reported that the tender to reclaim the island would be out in the third quarter of this year.

Island A will house industrial projects – which lots will be developed for sale to foreign and local investors to generate funds for PTMP – and residential development, while Island B will accommodate the state administrative offices and commercial properties.

Residential properties will be developed on Island C.

The LRT is an integrated transport solution comprising a monorail link, cable cars and water taxis to solve traffic congestion in Penang while the 19.5km PIL highway project connects Gurney Drive to the Penang International Airport.

The LRT begins from Komtar in the northeast corner of the island and passes through Jelutong, Gelugor, Bayan Lepas and the airport before ending at Island B. – The Star

Read more

Khalid: Council gave 18 recommendations

CAP, SAM welcome Fed Govt clarification on Penang reclamation …

|

New line: The proposed LRT route from Komtar to the three man-made

islands in Batu Maung in a map provided by the state government. |

</div

THE Penang government should first study the assessment rates for different categories of properties before imposing a blanket tax on everyone which is unfair, says Citizen Awareness Chant Group (Chant) legal adviser Citizen Awareness Chant Group (Chant) (pic).He said the state should look into the categories of assessment rates like those imposed in developed countries before imposing the rates on ratepayers.

THE Penang government should first study the assessment rates for different categories of properties before imposing a blanket tax on everyone which is unfair, says Citizen Awareness Chant Group (Chant) legal adviser Citizen Awareness Chant Group (Chant) (pic).He said the state should look into the categories of assessment rates like those imposed in developed countries before imposing the rates on ratepayers.